Brexit negotiations and covid-19: United Kingdom defeats the odds

The first week of July was the busiest the UK Intellectual Property Office has ever seen, putting to rest any fears that ongoing Brexit negotiations and the coronavirus pandemic might have lasting effects on application levels.

As a market, the United Kingdom has been stuck in a form of limbo since the 2016 EU referendum that determined the island nation would be striking out on its own. Having participated in the continent’s free-trade ecosystem for nearly 50 years, there is now a degree of uncertainty regarding the United Kingdom’s future relationships with other countries, especially given that Brexit trade talks have been rocky at best. This large unknown, combined with the recent coronavirus crisis, suggests that the United Kingdom is poised to suffer the worst economic crash of any major economy this year. Yet despite all of the negative headlines, trademark practitioners have some reason to cheer: brands are not holding off from filing. In fact, they are filing more.

Brexit creates more work – not less

The UK Intellectual Property Office (UKIPO) has taken the Brexit-induced changes in its stride. The office’s Corporate Plan 2020 to 2021 states that it is preparing to create over 2 million trademarks and designs at the end of the transition period in a bid to clone existing EU rights onto the UK register. This is a significant amount of work, but the UKIPO was already planning to recruit additional employees to assist with the expected increase in demand for trademarks. While there has been speculation about how covid-19 will affect these plans, it seems that things are in full swing at the office. A UKIPO spokesperson told World Trademark Review that the office is continuing with the recruitment process in line with longer-term business plans. Indeed, while it is monitoring the situation carefully, the UKIPO recently advertised 10 trademark examiner roles on LinkedIn.

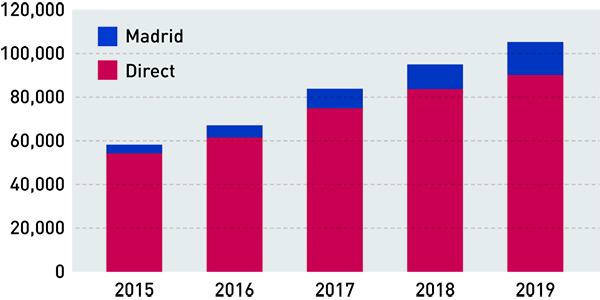

Despite original uncertainty about the impact that Brexit would have on activity at the UKIPO, it has reported strong growth in filing levels thus far. In 2019 it received 107,527 trademark applications, up 12.9% on 2018 (see Figure 1). Registration levels were also up by 16.7%, resulting in a record year for both application numbers and registrations. In fact, these figures have increased year on year since 2011.

Figure 1: UK trademark registrations

Source: UKIPO facts and figures

The UKIPO’s income from trademark activity was set at £37,742,000 for 2019 to 2020 and is expected to increase to £43,726,000 during the 2020-2021 period (although the Corporate Plan 2020 to 2021) notes that these estimates were made before the coronavirus pandemic).

Filing data at the office reveals that applicants most often file directly in the United Kingdom, rather than using the Madrid Protocol (see Figure 2). However, there was a surge in applications filed via the WIPO route in 2016 and 2017 (see Table 1) – arguably as a result of the Brexit referendum. CompuMark’s director of government and content strategy, Robert Reading, explains that many applicants were “hedging their bets” by filing both EU trademarks and separate UK applications at the time, as well as adding the United Kingdom as a separate designation when filing through the Madrid Protocol, in order to ensure that they would be protected regardless of the outcome of the vote.

Figure 2: UKIPO filings – direct versus Madrid

Source: CompuMark

Table 1: Annual growth of UKIPO filings – direct versus Madrid

| Direct | Madrid | |

|---|---|---|

| 2015 | 6% | -2% |

| 2016 | 14% | 35% |

| 2017 | 22% | 59% |

| 2018 | 12% | 26% |

| 2019 | 8% | 37% |

Source: CompuMark

2019 breakdown

As previously mentioned, 2019 was a big year for the UKIPO, receiving 107,527 trademark applications overall. Marks & Clerk, Stobbs and Murgitroyd were the top filing firms of the year, lodging 736, 635 and 625 applications, respectively (see Table 2).

Table 2: Top UK filing firms – 2019

| Firm | Number of applications |

|---|---|

| Marks & Clerk | 736 |

| Stobbs | 635 |

| Murgitroyd | 625 |

| HGF | 593 |

| Barker Brettell | 593 |

| Trademark Eagle | 571 |

| D Young | 564 |

| Wilson Gunn | 539 |

| Bird & Bird | 498 |

| Trademark Wizards | 472 |

| Fieldfisher | 470 |

| Forresters | 466 |

| Boult Wade Tennant | 431 |

| Urquhart-Dykes & Lord | 403 |

| Kilburn & Strode (includes Jeffrey Parker) | 353 |

Source: CompuMark

In terms of corporate fillers, the top local applicants were Independent Vetcare Limited, with 121 applications, Unilever, with 89 applications, and Glaxo Group, with 81 applications (see Table 3).

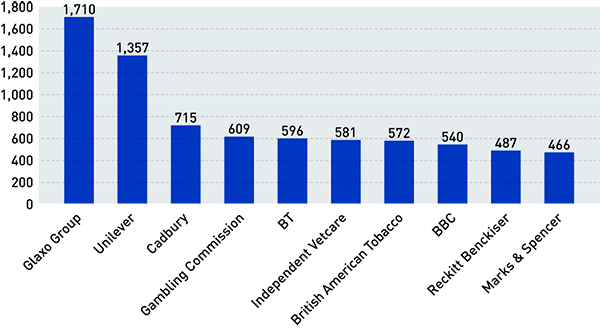

Meanwhile, the owners of the largest active portfolios in the United Kingdom are Glaxo Group, Unilever and Cadbury. Other major domestic firms to feature in the top 10 include BT, British American Tobacco and the BBC (see Figure 3).

Figure 3: Largest active UK portfolios

Source: CompuMark

Table 3: Top domestic filers – 2019

| Corporate | Number of applications |

|---|---|

| Independent Vetcare Limited | 121 |

| Unilever | 89 |

| Glaxo Group | 81 |

| Rehear Labs | 71 |

| Atom Supplies Limited | 63 |

| Biotech Life Sciences | 52 |

| British American Tobacco | 46 |

| Gambling Commission | 45 |

| The Boots Company PLC | 42 |

| Bet365 Group | 39 |

| Firth Steels Limited | 39 |

| Nicoventures Holdings Limited | 39 |

| Wong Sui Lin | 39 |

Source: CompuMark

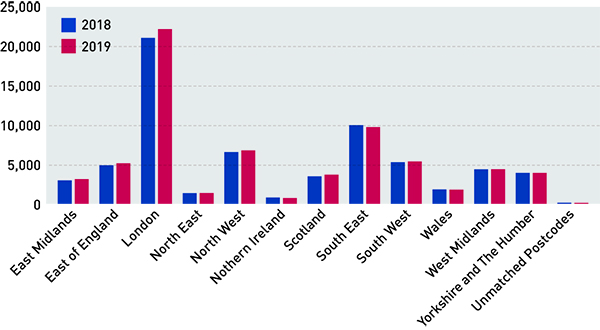

Unsurprisingly, analysis conducted by the UKIPO shows that most domestic trademark applications originate in London (see Figure 4). A total of 22,244 applications were filed in the capital in 2019, with 19,111 subsequent registrations. The second most popular region, the South East, saw 9,781 applications, of which 8,312 made it to registration.

When it comes to applications filed abroad in 2019, UK companies were most active in China, at the EUIPO and in the United States (see Figure 5).

Figure 4: Domestic trademark applications by region

Source: UKIPO

Figure 5: UK companies filing at international registries – 2019

Source: CompuMark

In return, applicants from China and the United States were also the most prolific foreign filers at the UKIPO (see Figure 6). In fact, the two countries are neck and neck when it comes to trademark volume, with Chinese-based businesses filing 9,557 applications in 2019, compared to 9,381 filed by US brands. In both countries, the tendency is to file direct applications rather than use the Madrid Protocol.

Further, the top foreign filers of 2019 were Huawei (109 trademark applications), Samsung Electronics (80) and Google (78) (see Table 4).

Figure 6: UK trademark applications by foreign filers – 2019

Source: CompuMark

Table 4: Top foreign filers – 2019

| Corporate | Country | Number of applications |

|---|---|---|

| Huawei | China | 109 |

| Samsung Electronics | South Korea | 80 |

| United States | 78 | |

| Amazon | United States | 60 |

| Philip Morris | Switzerland | 59 |

| Qiagen | Germany | 55 |

Source: CompuMark

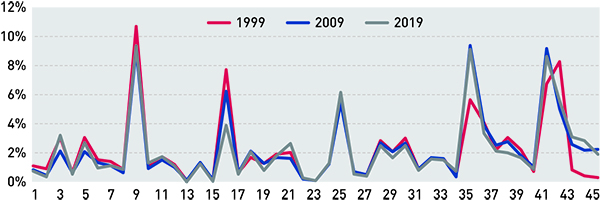

Digging deeper into the products and services being applied for, filing trends have generally remained stable over the years (see Figure 7). That said, the largest decline since 1999 was in Class 16 (paper and printed material), which is also reflected in other major markets. Notably, the use of service classes (Classes 35 and 45) increased from 35% to 42% in 2019.

Figure 7: UK trademarks by Nice class

Source: CompuMark

Coronavirus impact, or lack thereof

The latest UKIPO data shows that trademark activity in the country is far from struggling – it is flourishing. Overall application volume is up by 17% on the same period last year (see Figures 8 and 9). Reading points out that the first week of July was the busiest week that the UKIPO has ever experienced, with more than 2,700 new trademark applications filed. In fact, there are now more UK trademark applications filed in an average week than were filed in an average month 10 years ago.

Figure 8: New UK applications by week

Source: CompuMark

Figure 9: Total UK applications by week – 2019 versus 2020

Source: CompuMark

According to Reading, the increase in trademark volume is being driven by UK applicants that are still filing EU trademark applications at a level in line with previous years. On 31 December 2020 only registered EU trademarks are scheduled to be cloned onto the UK register at no cost to the owner, with a fee in place to replicate pending applications. Typically, it takes an EU trademark three-and-a-half months to reach registration, provided that there are no obstacles. But Reading says that the average timeframe from filing to registration is currently 177 days (ie, roughly six months). This means that an EU trademark filed today is unlikely to be registered in time to reach the 31 December cut-off. However, only 2% of EU applications filed in the first week of July were also filed as separate UK trademark applications. Ultimately, the level of duplication that many were expecting is yet to be seen.

Also, since the UK lockdown period began, there have been higher levels of self-filing applicants handling the process independently of an agent (see Figure 10). Nevertheless, the filing statistics are extremely positive for trademark practitioners, and may mean that the UKIPO does not have to revise its expected trademark income for next year.

Figure 10: UK applications by week – 2020

Source: CompuMark

Comment

The United Kingdom may be experiencing its worst economic downturn in 300 years, but this is certainly not reflected in its trademark landscape. Despite well-founded fears that the coronavirus pandemic – and subsequent lockdowns to contain it – would wipe out filing activity, this is yet to be the case. That said, practitioners may be concerned that more and more applicants have turned to self-filing.

It is hard to predict how the UK economy will develop in the coming months and years. It is undoubtedly facing unprecedented challenges right now, but the UK government seems committed to helping the economy bounce back with a sizeable stimulus package. It is encouraging that – despite the extreme financial difficulties – many businesses are still finding ways to protect their intangible assets.