Perfectly positioned: how Mexico has established itself as an IP leader in Latin America

Data analysis reveals that the Mexican registry boasts an impressive roster of valuable brands – aided largely by an advanced system that has proved attractive to the country’s northern neighbours.

Mexico’s unique geographical location, which enjoys access to both North American and Latin American markets, has been of great benefit to rights holders far and wide. Recognising the value of a well-rounded IP system, the Mexican Institute of Industrial Property (IMPI) has undertaken significant initiatives to bolster its position over recent years. This has helped to make the country not only a more attractive destination for domestic and foreign rights holders, but also an IP leader in the region.

In March 2020 Mexico took an important step in strengthening its IP system by acceding to the WIPO Hague Agreement. The move, which was required by the trilateral United States-Mexico-Canada Agreement, was not only designed to reinforce the Mexican IP ecosystem, but also marked a major win for WIPO – as Mexico became the first Spanish-speaking country in Latin America to join the Hague System.

In May IMPI made another announcement that would boost its IP standing – the unveiling of a new digital platform that enables all trademark-related processes to now be completed online. Accelerated by the ongoing covid-19 pandemic, the decision to launch this platform has been a key component of IMPI’s outstanding commitment to introduce more digital tools.

An overview of filing activity

IMPI’s dedication to improving Mexico’s IP ecosystem is welcome news to US brand owners, which file around 50% of all applications lodged in the country by foreign applicants (see Table 1). Corporates from China and Canada are also busy at the register. The number of Chinese applicants jumped significantly in 2018, with the same volume of filings maintained throughout 2019. Trademark applications filed by Canadian companies were steady in 2017 and 2018, before experiencing a slight uptick in 2019.

Table 1: Top filers in Mexico by country

| 2017 | 2018 | 2019 | |||

|---|---|---|---|---|---|

| Country | Number of filings | Country | Number of filings | Country | Number of filings |

| United States | 11,639 | United States | 11,592 | United States | 11,217 |

| Spain | 1,036 | China | 1,393 | China | 1,451 |

| China | 812 | Canada | 882 | Canada | 1,250 |

| Canada | 702 | Spain | 853 | Spain | 891 |

| Japan | 613 | United Kingdom | 621 | United Kingdom | 605 |

| Switzerland | 601 | Switzerland | 604 | Germany | 547 |

| United Kingdom | 573 | Japan | 546 | Japan | 534 |

| Germany | 426 | Brazil | 538 | Switzerland | 534 |

| South Korea | 407 | Germany | 490 | South Korea | 377 |

| Brazil | 391 | South Korea | 336 | Brazil | 310 |

The country rankings in Table 1 make sense in the context of trade relationships. The United States has the highest vested interest in Mexico, with US products accounting for 44% (or $206 billion) of the country’s imports in 2019. Chinese products represented 17.7% of imports in the same year, and Japanese products 3.85%.

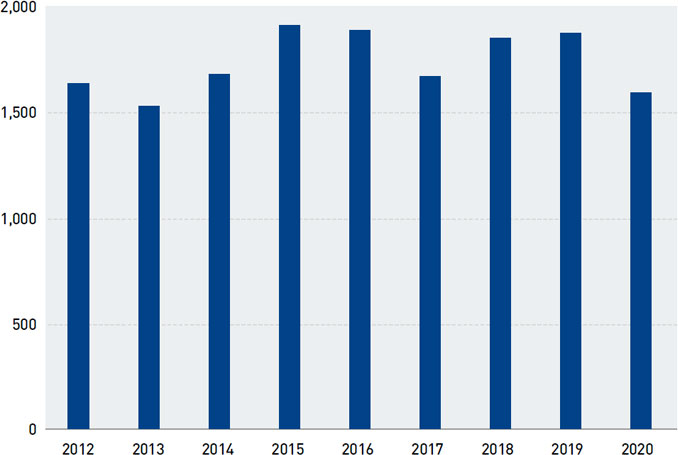

Overall, local businesses account for the bulk of activity at the Mexican registry (see Figure 1). However, Figure 2 reveals that filing growth has been minimal in recent years. The spike in Madrid designations was a direct result of Mexico joining the Madrid System in 2013. According to Robert Reading, CompuMark’s director of government and content strategy, foreign applicants immediately switched from national applications to the WIPO route.

Figure 1: Filing activity in Mexico

Source: CompuMark

Figure 2: Annual growth in Mexican applications

Source: CompuMark

When it comes to domestic brands, the priority continues to be to obtain protection in countries that are near to Mexico (see Table 2). Because many neighbouring countries are not members of the Madrid System, local brand owners place a low emphasis on WIPO filings, explains Reading. According to his analysis, Mexican applicants generally file between only 70 and 80 applications via WIPO each year – even fewer than applicants from Liechtenstein, which has a population size 0.03% that of Mexico.

Table 2: Top registries for Mexican brand owners

| 2017 | 2018 | 2019 | |||

|---|---|---|---|---|---|

| Register | Number of filings | Register | Number of filings | Register | Number of filings |

| US federal | 1,679 | US federal | 1,860 | US federal | 1,885 |

| Guatemala | 714 | Guatemala | 561 | China | 500 |

| Argentina | 554 | China | 503 | Guatemala | 494 |

| China | 465 | Peru | 491 | Peru | 485 |

| Colombia | 448 | Argentina | 481 | Colombia | 409 |

| Peru | 440 | Panama | 406 | Argentina | 408 |

| El Salvador | 418 | Colombia | 406 | Brazil | 389 |

| Honduras | 403 | El Salvador | 353 | Chile | 311 |

| Costa Rica | 374 | Brazil | 346 | Costa Rica | 309 |

| Brazil | 360 | Costa Rica | 345 | Panama | 300 |

In terms of activity from Mexican companies, the United States is the only leading register to receive a growing number of applications over the past three years, with an increase of 1.3% between 2018 and 2019. Although unlikely to bowl readers over, this statistic should still come as good news considering the circumstances. The relationship between the United States and Mexico was a tense one under the Trump administration, which made tackling illegal immigration from the country a central, and divisive, policy plank. Yet despite a small drop in US filing levels by Mexican applicants in 2017, Trump’s policies appear to have had no lasting impact (see Figure 3). As such, it is highly unlikely that Joe Biden’s presidency will have much of an effect on application levels either.

Figure 3: US trademark applications filed by Mexican applicants

Source: CompuMark

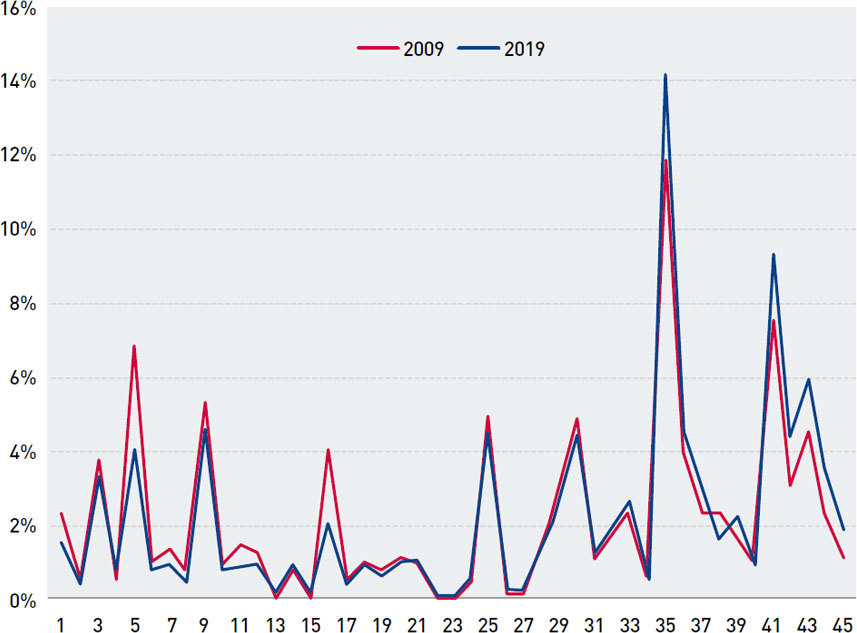

From a Nice Class perspective, Mexican filings have been relatively consistent over the past decade (see Figure 4). The only declines worth noting have been in Classes 5 (pharmaceuticals) and 16 (printed matter), while service classes have increased in importance.

Figure 4: Mexican national trademark applications by Nice Class

Source: CompuMark

Mexican brands dominate brand value in Latin America

A large proportion of local brands are focused on immediate markets, yet despite this, Mexican brands are still achieving international success. Corona is both Mexico’s and Latin America’s most valuable brand, according to Brand Finance. Worth just over $8 billion, the widely popular beer brand is exported to 120 countries. Another alcohol brand, Diageo-owned Don Julio, was Mexico’s fastest growing brand in 2020 – its brand value up by 78.8% from the year before. Don Julio’s skyrocketing value is attributed to strong financial results and growth outside its home country.

Indeed, Mexican brands have a significant presence in Brand Finance’s Latin America 100 2020 ranking, holding 37 spots and accounting for 42% of the value of the list – demonstrating yet again the importance of the Mexican market in the region.

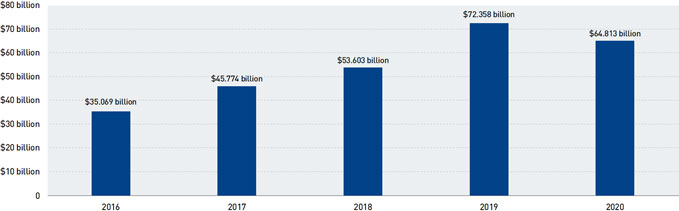

As a whole, Mexico’s brand value had been enjoying steady growth since 2016. However, this trend was interrupted in 2020 (see Figure 5).

Figure 5: Mexican brand value

Source: Brand Finance

The most active applicant in Mexico in 2019 was Grupo Bimbo, followed by Walmart and Mexicana de Lubricantes (see Table 3). Bimbo is one of the country’s most popular fast-moving consumer goods brands and has even outperformed Coca-Cola in terms of household penetration rates. US heavyweights Home Depot, Amazon and Target also feature in the ranking.

Table 3: Top registries for Mexican brand owners

| Brand owner | Country of origin | Number of applications |

|---|---|---|

| Grupo Bimbo | Mexico | 294 |

| Walmart | United States/Mexico | 287 |

| Mexicana de Lubricantes | Mexico | 277 |

| Zitro IP | Luxembourg | 256 |

| Home Depot | United States | 236 |

| G&W distilling | Canada | 231 |

| Televisa | Mexico | 213 |

| Amazon | United States | 213 |

| Target | United States | 180 |

| Sanborn Hermanos SA | Mexico | 176 |

Source: CompuMark

The top three trademark filers in 2019 are also the most prolific of the past decade, although Walmart surpasses Bimbo with a total of 5,073 applications (see Table 4). Walmart’s high visibility in these rankings is to be expected given the sheer number of products that it launches each year. What is more, as of 2019 it is the largest company on the Mexican Stock Exchange.

Table 4: Top applicants in Mexico – 2010-2019

| Brand owner | Number of applications |

|---|---|

| Walmart | 5,073 |

| Grupo Bimbo | 4,498 |

| Mexicana de Lubricantes | 3,691 |

| Televisa | 3,602 |

| Coppel | 2,088 |

| Amazon | 1,691 |

| TV Azteca | 1,673 |

| Home Depot | 1,653 |

| LG Electronics | 1,462 |

| Target | 1,398 |

Source: CompuMark

Meanwhile, the leading representatives in 2019 were Maria Teresa Eljure Tellez, Enrique Alberto Diaz Mucharraz and Georgina Esteva Wurts (see Table 5).

Table 5: Top representatives on the Mexican register – 2019

| Representative | Number of applications |

|---|---|

| Maria Teresa Eljure Tellez | 1,822 |

| Enrique Alberto Diaz Mucharraz | 1,407 |

| Georgina Esteva Wurts | 1,265 |

| Consuelo Gonzalez Rodriguez | 1,217 |

| Jose Francisco Javier Segundo Hinojosa Cuellar | 1,094 |

| Eryck Armando Castillo Orive | 994 |

| Adriana Garcia Ordaz | 899 |

| Luis Javier Legarreta Cantu | 780 |

| Cynthia Madrigal Dominguez | 738 |

| Eduardo Kleinberg Druker | 735 |

Source: CompuMark

Comment

Mexico has distinguished itself in Latin America for its sophisticated IP ecosystem, which benefits brand owners both locally and abroad. The data demonstrates just how stable the Mexican trademark landscape is – a positive takeaway indeed, considering how tumultuous the country’s relationship has been with the United States, its largest trading partner and a significant source of foreign applications, over the past four years.